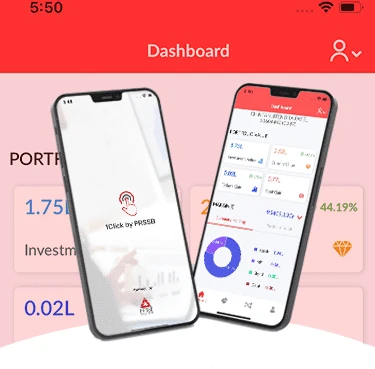

Finance App Development

In the fast-evolving fintech era, we empower financial institutions to digitize, secure, and automate their operations with next-gen solutions. Our expertise in SaaS, cloud technology, and AI-driven finance apps helps businesses enhance efficiency, ensure compliance, and deliver seamless customer experiences. With our scalable and secure digital platforms, financial enterprises can simplify workflows and strengthen client trust.

Our Expertise Includes:

- Loan processing and management systems

- CRM and client engagement platforms

- Responsive websites and content management systems

- Cloud-based database and reporting solutions